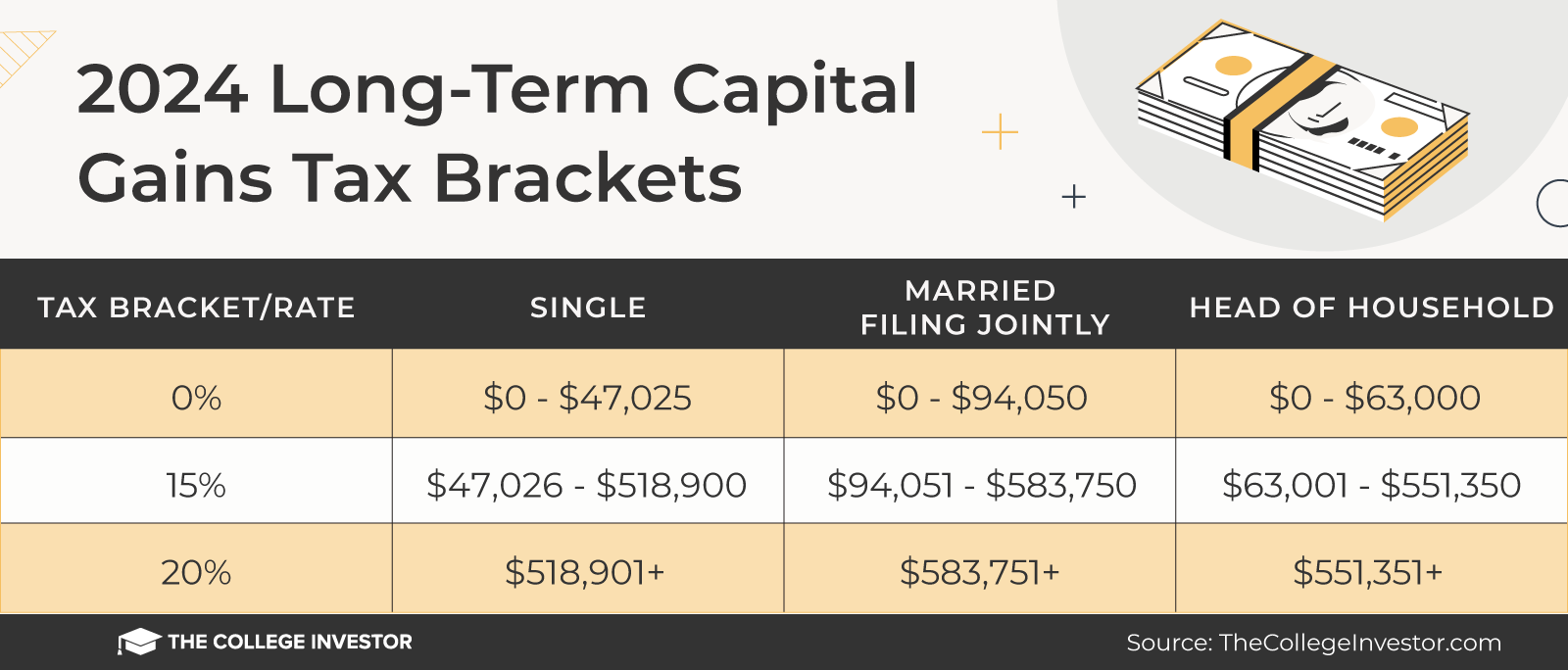

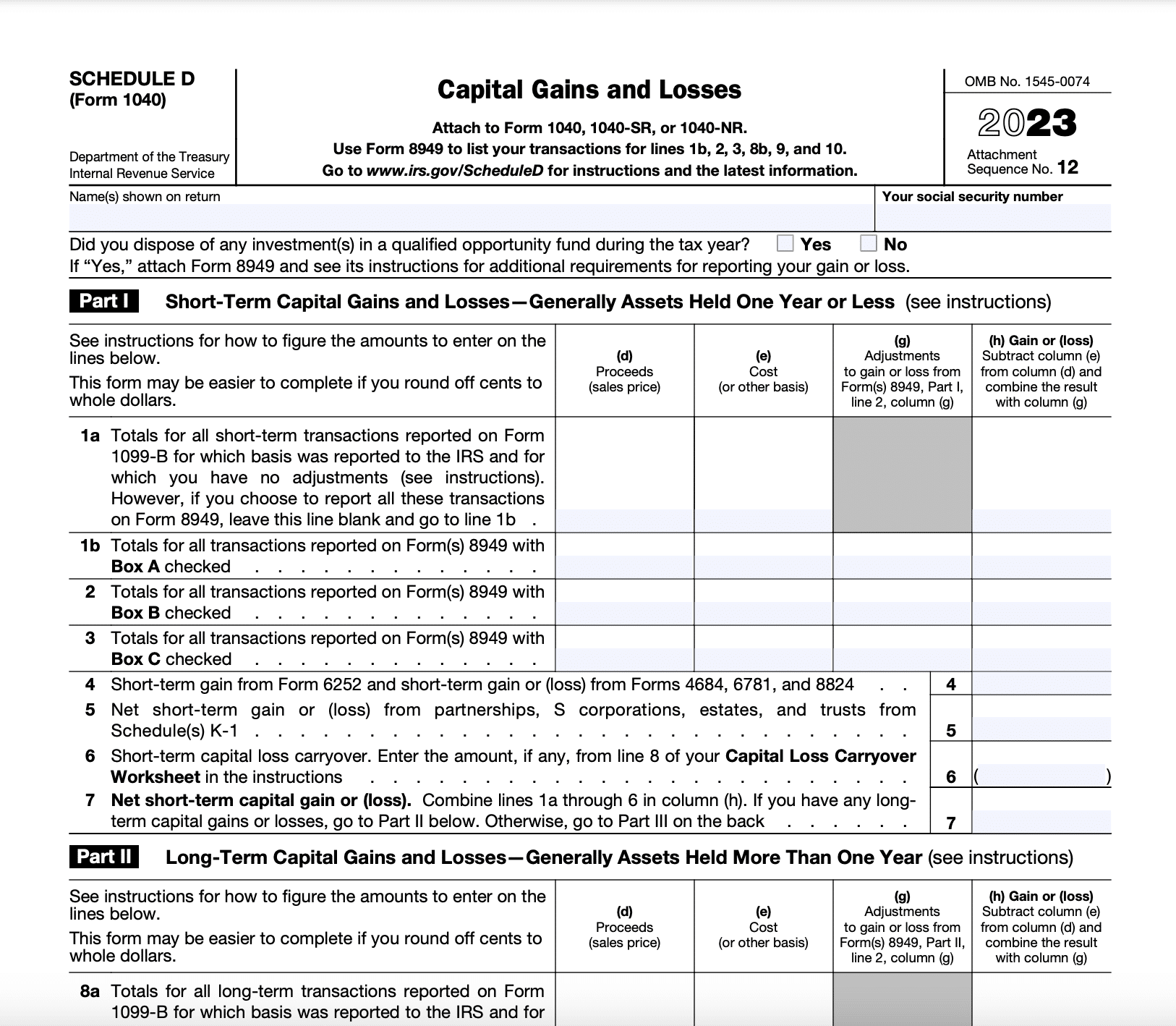

2024 Schedule D 2024 Capital Gains – Capital gains are the profit you make when you sell a capital asset (such as real estate, furniture, precious metals, vehicles, collectibles or major equipment) for more money than it cost you. The . Capital gains are reported on Schedule D, which is submitted with your federal tax return (Form 1040) by April 15, 2024, or Oct. 15, 2024, with an extension. The table above provides an overview .

2024 Schedule D 2024 Capital Gains

Source : thecollegeinvestor.comWhat the 2024 Capital Gains Tax Brackets Mean for Your Investments

Source : finance.yahoo.comCapital Gains Tax Brackets For 2024

Source : thecollegeinvestor.comWhat happened to Schedule C? (Q Mac) — Quicken

Source : community.quicken.comCryptocurrency and Taxes: A Guide for the 2023 2024 US Tax Season

Source : cryptonews.comPaul D. Diaz, EA, MBA on LinkedIn: Congress hasn’t made changes to

Source : www.linkedin.comFree Tax Clinic Bethpage VITA at Touro Law University – Nassau

Source : www.nslawservices.orgCapital Gains Tax Brackets For 2024

Source : thecollegeinvestor.comADDS Huntingdon TAX CLINIC 2024 Starting from February 19, 2024

Source : m.facebook.com2024 Capital Gains Tax Rates | SmartAsset

Source : smartasset.com2024 Schedule D 2024 Capital Gains Capital Gains Tax Brackets For 2024: Crypto losses or gains are reported on your personal tax form like any other capital gains tax, including options to offset a tax liability. . and the second section is for any long-term investment gains. Typically, the IRS form Schedule D, Capital Gains, and Losses would be used to report capital gains and losses. However, Form 8949 may .

]]>